Dallas, Texas July 08, 2024

The Sterling Group, an industrial focused middle market private equity firm, announced the addition of Jonathan Jackson as Managing Director of Foundation Fund, the firm’s lower middle market strategy.

Jonathan Jackson joins Sterling from Sun Capital Partners, where he spent thirteen years focused on middle market investing in a variety of services, industrial and food sectors. “Jonathan is a key addition to Foundation Fund’s senior leadership team,” said Lucas Cutler, Partner. Foundation Fund launched in 2023 to apply Sterling’s experience and operational capabilities by partnering with industrial companies in the lower middle market.

In addition, Sterling Foundation Fund has completed the acquisition of founder-owned OGD Overhead Garage Door (“OGD”), a provider of repair, replacement and installation services in the overhead door and dock industry. Headquartered in Fort Worth, Texas, OGD serves a large and growing base of commercial and residential overhead door and dock customers with installation and repair and replacement services. “We look forward to leveraging Sterling’s industry expertise and operational capabilities to continue to expand OGD,” said Bret Westbrook, founder and CEO of OGD.

Sterling has extensive experience partnering with founders to build residential and commercial service businesses. OGD is the fourth acquisition for Sterling Foundation Fund. Each partnership to date has been with founder owned businesses.

Adams Street Partners’ Private Credit investment strategy provided senior debt financing and an equity co-investment in support of the acquisition.

McDermott Will & Emery LLP served as legal counsel and HamptonRock Financial Advisory, LLC served as a financial due diligence advisor to The Sterling Group.

BlackArch Partners served as exclusive financial advisor to OGD Overhead Garage Door.

About OGD

OGD is a provider of repair, replacement and installation services in the overhead door and dock industry. OGD operates in 45 MSAs across the Southeast, Midwest, Mid-Atlantic and the Mountain West regions. OGD is headquartered in Fort Worth, Texas.

About The Sterling Group Foundation Fund

Founded in 1982, The Sterling Group is a private equity and private credit investment firm that targets investments in basic manufacturing, distribution, and industrial services companies. Typical enterprise values of these companies at initial formation range from $100 million to over $1 billion. Sterling has sponsored the buyout of 72 platform companies and numerous add-on acquisitions for a total transaction value of over $24.0 billion. Sterling recently closed its sixth investment fund with $3.5 billion in commitments and currently has $9.4 billion of assets under management. Launched in 2023, The Sterling Foundation Fund aims to leverage the firm’s operational capabilities and experience in the industrial sector to “set the foundation” for growth at lower middle market companies. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX April 22, 2024

The Sterling Group (“Sterling”), an operationally focused, industrial middle market private equity firm, is pleased to announce the closing of Sterling Group Partners VI, LP (together with its parallel fund, “Fund VI”). Fund VI exceeded its target of $2.75 billion and was significantly oversubscribed at its hard cap of $3.5 billion. Sterling’s previous fund closed in June 2020 with $2.0 billion of limited partner commitments.

The majority of Fund VI’s capital was committed by returning investors. Sterling welcomes several new investors that expand the firm’s Limited Partner base in the United States, Europe, the Middle East and Asia. “Sterling has a four-decade track record of value creation across the economic cycle,” added Franny Jones, Partner, Investor Relations. “The secular tailwinds underpinning today’s industrial middle market, when combined with our proven Seven Lever value creation strategy, present tremendous opportunities for Fund VI.”

Consistent with Sterling’s successful history over four decades, Fund VI will primarily target corporate carve-outs and family businesses in the industrial sector. The firm emphasizes its operational approach in partnership with management teams to grow and improve its portfolio companies. Sterling’s partner group, including Greg Elliott, Brian Henry, Scott MacLaren, Brad Staller, Kent Wallace, Jim Apple, Franny Jones and Jud Morrison have a collective 100-plus years working at Sterling.

Evercore Private Funds Group acted as the exclusive global placement agent, and Kirkland and Ellis, LLP served as fund counsel.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity and private credit investment firm that targets investments in basic manufacturing, distribution, and industrial services companies. Typical enterprise values of these companies at initial formation range from $100 million to $750 million. Sterling has sponsored the buyout of 71 platform companies and numerous add-on acquisitions for a total transaction value of over $24 billion. Sterling currently has $9.4 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

April 08, 2024

The Sterling Group (“Sterling”), a Houston-based, operationally focused middle market private equity firm, is pleased to announce that the Firm has been ranked #12 out of over 632 middle market private equity firms globally in the 2023 HEC-Dow Jones Middle Market Buyout Performance ranking.

Sterling has been partnering with management teams to grow and build winning businesses in the industrial sector for over forty years. “Sterling is honored to be ranked among the top performing private equity firms worldwide,” said Brian Henry, Partner at The Sterling Group. “This recognition by HEC-Dow Jones attests to the strength of our hands-on operational approach and intensive application of our Seven Levers methodology, driving strong results for our portfolio companies and our investors.” For more information, including the full ranking, criteria and methodology, please view the full report here.

The 2023 HEC Paris – DowJones Middle Market Buyout Performance Ranking seeks to answer the question: “Which firm(s) in the Middle Market Buyout segment generated the best performance for their investors over the past years?” The ranking analyzed performance data from 632 PE firms and the 1241 funds they raised between 2010 and 2019 with an aggregate equity volume of $2.18 trillion. The HEC-DowJones Ranking draws on private equity fund performance data provided by Preqin and data reported directly to HEC-DowJones.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity and private credit investment firm that targets investments in basic manufacturing, distribution, and industrial services companies. Typical enterprise values of these companies at initial formation range from $100 million to $750 million. Sterling has sponsored the buyout of 67 platform companies and numerous add-on acquisitions for a total transaction value of over $22.0 billion. Sterling currently has over $5.9 billion of assets under management. For further information, please visit www.sterling-group.com.

HEC Paris and Dow Jones (“HEC-Dow Jones”) released the 2023 HEC Paris-DowJones Middle Market Buyout Performance Ranking (the “Report”) on March 6, 2024. The Report is based on information sourced from Preqin and data reported directly by certain participants in the rankings described in the Report. The Sterling Group provided certain information to HEC-Dow Jones in connection with the preparation of the Report, which addresses certain middle-market buyout fund sponsors and fund vintage years of 2010-2019. The Report ultimately represents the opinion of HEC-Dow Jones and not of The Sterling Group. Neither HEC-Dow Jones nor The Sterling Group has independently verified or assessed the information provided by other parties in connection with the preparation of the Report. In addition, the methodology used by HEC-Dow Jones is subject to inherent limitations due to the confidential nature of the private equity industry, different vintage years, strategies or investment objectives of private equity firms and different performance measures used by such firms. The Sterling Group pays an annual subscription fee to Preqin for access to certain data but did not compensate Preqin or HEC-Dow Jones to be considered for, or ultimately receive, any ranking described in the Report. There can be no assurance that other providers or surveys would reach the same conclusion as the foregoing. The Sterling Group makes no representations or warranties as to accuracy, completeness or reliability of information contained in the Report. Information relating to the Report and its methodology is available here.

Houston, TX February 23, 2024

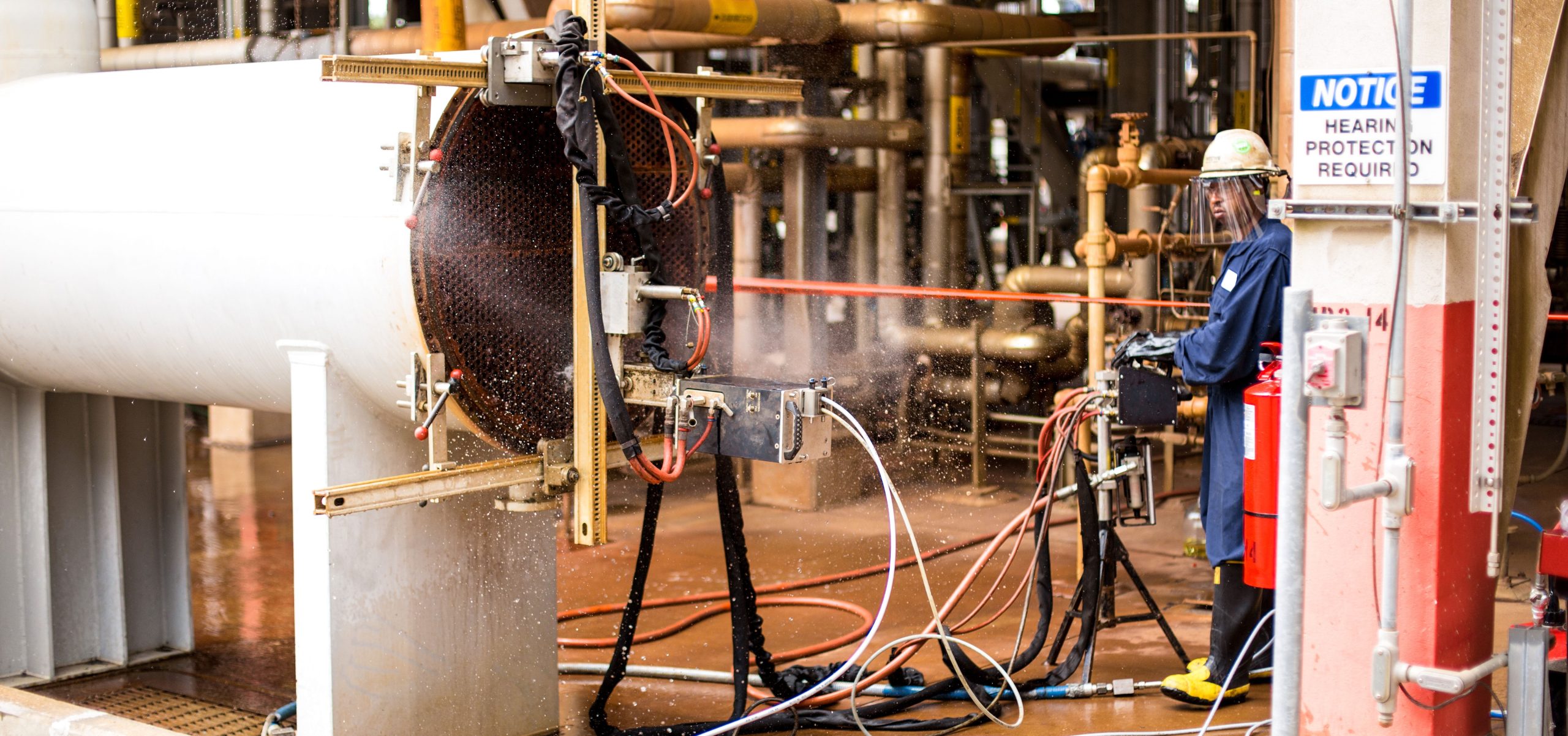

The Sterling Group (“Sterling”), a middle market private equity firm, announced today that it has completed the sale of Evergreen North America Industrial Services (“Evergreen”) to Quanta Services. Evergreen is a leading provider of specialized and recurring environmental solutions for a diverse range of blue-chip industrial businesses and mission critical infrastructure.

Sterling created Evergreen through the combination of family owned, New York based North American Industrial Services and Houston based Evergreen Environmental Services. Since the combination, Evergreen has continued to expand its footprint and grow its ability to serve customers with its solutions nationally. Combined with Quanta Services leadership in specialty infrastructure solutions, Evergreen is poised to continue its track record of delivering the highest quality services to its customers.

Latham & Watkins served as legal counsel and BlackArch Partners served as financial advisor to Evergreen and Sterling.

About Evergreen North America Industrial Services

Evergreen is a leading provider of environmental solutions to the downstream and midstream energy, industrial, and chemical sectors. With a customer-centric culture and employees committed to safety, integrity, accountability and adaptability, Evergreen serves a diverse set of end markets, including refining, power generation, petrochemical, manufacturing, mining, waste-to-energy, and pulp & paper at locations throughout North America. Additional information about Evergreen is available at www.enais.com.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity and private credit investment firm that targets investments in basic manufacturing, distribution, and industrial services companies. Typical enterprise values of these companies at initial formation range from $100 million to $1 billion. Sterling has sponsored the buyout of 67 platform companies and numerous add-on acquisitions for a total transaction value of over $22 billion. Sterling currently has over $6 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX February 20, 2024

The Sterling Group (“Sterling”), a Houston-based, operationally focused middle market private equity firm, is pleased to announce eight internal promotions: John Griffin and Meghan Leggett to Managing Director; Jared North to Managing Director, Business Development; Johann Friese to Director; Anu George to Director, Fund Accounting; Aryan Sameri to Director, Commercial Diligence & Strategy; Jacob Broom to Principal, Private Credit; and Patrick Vocke to Principal.

In addition, Jenny Harris, current Managing Director, Private Credit, has been named Managing Director, Capital Markets for all of Sterling’s investment strategies.

“Since 1982, Sterling has been building winning businesses for customers, employees, and investors, and this would not be possible without a team of highly skilled and passionate individuals such as the ones being recognized here. We are proud to celebrate those who have been promoted for their contributions to the firm,” said Brad Staller, Partner at The Sterling Group.

To learn more about a career at The Sterling Group, please visit www.sterling-group.com/careers/ or contact Claudine Lussier at clussier@sterling-group.com.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity and private credit investment firm that targets investments in basic manufacturing, distribution, and industrial services companies. Typical enterprise values of these companies at initial formation range from $100 million to $750 million. Sterling has sponsored the buyout of 67 platform companies and numerous add-on acquisitions for a total transaction value of over $22.0 billion. Sterling currently has over $6.0 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Denver, CO December 18, 2023

Frontline Road Safety, LLC (“Frontline”), a portfolio company of The Sterling Group (“Sterling”), today announced the acquisition of The Aero-Mark Company, LLC (“Aero-Mark”). Frontline’s operating companies provide pavement marking and ancillary services to a variety of end markets and customers.

The Aero-Mark transaction marks Frontline’s twelfth acquisition since the platform was established in July 2020. Headquartered in Streetsboro, Ohio, with an additional location in Cincinnati, Aero-Mark is a leading pavement marking contractor that provides state DOTs and general contractor customers with the highest levels of service and work quality. “This partnership with Frontline will allow us to expand our reach and capabilities, benefiting our customers and employees alike,” said Mike Krenn and Curt Huffman, Co-Owners of Aero-Mark.

“We are excited to partner with the Aero-Mark team and to continue building our presence in the Midwest,” said Mitch Williams, CEO of Frontline Road Safety. “The Aero-Mark team is known across the industry for its commitment to quality, service and safety. Aero-Mark will be a terrific addition to the Frontline platform.”

Over the last several years, Sterling has executed on its investment thesis to build a leader in the road safety and infrastructure maintenance industry. Through organic growth and further acquisitions, Sterling intends to continue building Frontline into the leading platform for road safety solutions with best-in-class local execution capabilities. Sterling has a long history of partnering with entrepreneurs and management teams to support the growth of their businesses.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity and private credit investment firm that targets investments in basic manufacturing, distribution, and industrial services companies. Typical enterprise values of these companies at initial formation range from $100 million to $1 billion. Sterling has sponsored the buyout of 67 platform companies and numerous add-on acquisitions for a total transaction value of over $22.0 billion. Sterling currently has over $6.0 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

St. Louis, MO November 06, 2023

West Star Aviation (“West Star”), a portfolio company of The Sterling Group, has announced that it has acquired Jet East. West Star is a leading provider of maintenance, repair, and overhaul (“MRO”) services to the business aviation industry providing maintenance, modification, and other services to aviation customers. Jet East provides MRO services as well and focuses on supporting fractional and managed fleet operators. Capabilities include an expansive ‘Aircraft on Ground’ (“AOG”) mobile repair technician network, line maintenance operations, heavy maintenance facilities, and other complementary services.

“I’m extremely happy to welcome the Jet East employees to West Star. Both West Star and Jet East are remarkable companies with strong and unique cultures,” said Jim Rankin, CEO of West Star Aviation. “I’m looking forward to bringing the Jet East and West Star teams together as we build the premier Business Aviation Maintenance provider in the industry. Our focus now is to use this combination to better serve our customers and support our employees.”

“I am thrilled about this new chapter for the combined company of West Star and Jet East. With the official close, we are provided a unique opportunity to enhance our capabilities and expand our offerings to better serve the needs of the aviation industry. As we turn our attention toward the exciting task of strategic integration, we remain committed to our customers so there is no disruption to the service that we provide. I am proud of what has been accomplished and excited about the future,” said Stephen Maiden, CEO of Jet East.

“We were thrilled to help play a part in bringing together these two world class teams to combine complementary capabilities, geographies, and customer bases. We couldn’t be more excited in welcoming the entire Jet East family to West Star,” added Greg Elliott and John Griffin, Board Members of West Star Aviation.

This partnership will bring together two of the best teams in business aviation that together will become stronger through added scale and expanded capabilities. Customers and vendors should expect no change while leaders of each organization work together on longer-term integration planning.

Latham & Watkins LLP served as legal counsel and Jefferies, LLC served as a financial advisor to West Star.

About West Star Aviation

West Star Aviation specializes in airframe repair and maintenance, engine repair and maintenance, major modifications, avionics installation and repair, interior refurbishment, paint, parts, surplus avionics sales, window repair and accessory services. The company also provides complete FBO services for transient aircraft at its East Alton and Grand Junction facilities. West Star provides services at four primary locations in East Alton, Illinois; Grand Junction, Colorado; Chattanooga, Tennessee; and Perryville, Missouri, as well as fifteen mobile repair bases and satellite MRO facilities. West Star also provides parts distribution and composite repair services through its Avant and DAS businesses respectively. For more information, please visit weststaraviation.com.

About Jet East, a Gama Aviation Company

Jet East, A Gama Aviation Company, is one of the nation’s leading aviation maintenance providers. The company specializes in scheduled maintenance, on-demand mobile maintenance for unscheduled events, paint and interior completions and provides related services in the areas of structural repairs, composite work, and non-destructive testing (NDT). With a deeply talented workforce, Jet East is available to meet customer maintenance needs with on-demand service and coast to coast coverage in the U.S and in certain international markets. An expansive AOG Mobile Maintenance team operates with a 24/7 Dispatch Team and compliments the company’s maintenance hangars in North Carolina, New York, New Jersey, Florida, Texas, California, Illinois, and Nevada. For more information, please visit jeteastgama.com.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity and private credit investment firm that targets investments in basic manufacturing, distribution, and industrial services companies. Typical enterprise values of these companies at initial formation range from $100 million to $1 billion. Sterling has sponsored the buyout of 67 platform companies and numerous add-on acquisitions for a total transaction value of over $22.0 billion. Sterling currently has over $6.1 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Ashland, VA September 27, 2023

Fencing Supply Group (“FSG”), a portfolio company of The Sterling Group, announced that it has acquired Atlantic Fence Supply (“AFS” or “The Company”), an experienced fence supplier known for their customer service and reliability serving Richmond, Tidewater and the surrounding Virginia area. AFS is a leading wholesale distributor of ornamental, vinyl, wood, and chain link fencing, as well as custom gates, and operates from their branch location in Ashland, Virginia.

Established in 1998, AFS prides itself on providing outstanding customer service with a sales staff that has more than 50 years of combined fence experience. The company focuses on the fabrication of chain-link gates, kennels and aluminum slide gates, as well as standard and custom vinyl fence styles. Macon Powers, President of Atlantic Fence Supply, said “Joining Fencing Supply Group will provide many opportunities for our employees and customers. We are excited to expand our capabilities and continue to give our customers the dedication they have come to expect.”

“We are very excited to help AFS build on their outstanding track record and continue to grow their business. The company is built on a cultural foundation of integrity, trust and taking care of its people, which aligns with our values,” said Andrea Hogan, CEO of Fencing Supply Group.

ABOUT FENCING SUPPLY GROUP

Founded in 2021, Fencing Supply Group (FSG) is a group of industry-leading fencing distributors. FSG is the largest wholesale distributor and manufacturer of fencing and outdoor living supplies in the United States. FSG businesses serve professional fencing contractors who provide new, improvement, and repair fencing services across residential, industrial, commercial, and infrastructure end markets. The FSG model combines local relationships, service, and expertise with national scale and resources to benefit customers, employees, and suppliers. Current FSG companies include Binford Supply, Cedar Supply, Fence Supply, Hartford Fence, Merchants Metals, Pro Access Systems, Sharon Fence Distributors, Specialty Fence Wholesale Jacksonville, Specialty Fence Wholesale Mulberry, and Vinyl by Design, which collectively operate over 70 branches across more than 30 states. For further information, please visit fencingsupplygroup.com

ABOUT THE STERLING GROUP

Founded in 1982, The Sterling Group is a private equity and private credit investment firm that targets investments in basic manufacturing, distribution, and industrial services companies. Typical enterprise values of these companies at initial formation range from $100 million to $1 billion. Sterling has sponsored the buyout of 66 platform companies and numerous add-on acquisitions for a total transaction value of over $22.0 billion. Sterling currently has over $6.1 billion of assets under management. For further information, please visit www.sterling-group.com.

Dallas, TX September 01, 2023

Artisan Design Group (“ADG”), a portfolio company of The Sterling Group, today announced the acquisition of KB Kitchen & Bath (“KB”). ADG is a leading provider of interior finish products and installation to homebuilders, multi-family developers, and institutional property owners. Based in South Carolina, KB is a cabinet installer and distributor primarily serving the single-family housing market.

“We are thrilled to work with KB and to strengthen ADG’s presence in the Carolinas,” said Steve Margolius, CEO of Artisan Design Group. “This acquisition will provide ADG with greater coverage of the single-family market and will enhance our cabinet offering in this region.”

“Our partnership with ADG will provide us with an exciting opportunity to expand operations alongside an industry leader, allowing us to better serve our customers,” said Bob Wilkes, President & CEO of KB Kitchen & Bath.

About Artisan Design Group

ADG is a provider of design, procurement, and installation services for flooring, cabinets and countertops, serving homebuilders, multi-family developers and institutional property owners. Headquartered in Dallas, Texas, ADG operates more than 160 distribution, design and service facilities and coordinates installation through over 3,400 personnel across 25 states. ADG was formed in 2016 through the combination of Floors Inc. and Malibu Floors. ADG has completed fifteen acquisitions over the past four years under Sterling’s ownership. The company has completed twenty-two total acquisitions since its founding in 2016. ADG continues to seek local and regional market leaders to add to its family of flooring, cabinets and countertops specialists.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity and private credit investment firm that targets investments in basic manufacturing, distribution, and industrial services companies. Typical enterprise values of these companies at initial formation range from $100 million to $1 billion. Sterling has sponsored the buyout of 66 platform companies and numerous add-on acquisitions for a total transaction value of over $22.0 billion. Sterling currently has over $6.1 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Dallas, TX August 02, 2023

Compost360 Completes First Acquisition, Nature’s Choice

The Sterling Group, an operationally focused middle market private equity firm, today announced the formation of Compost360, a new platform focused on building a leading processor of organic waste material and producer of high quality, sustainable landscaping products. Sterling is partnering with two industry executives, Steve Carn and Randy Arnold, who will serve as CEO and COO of the Compost360 platform.

Compost360 is pleased to announce the acquisition of Nature’s Choice, an organic waste recycling company and producer of compost, mulch and engineered soils based in New Jersey. Nature’s Choice is the first acquisition of the Compost360 platform.

“We look forward to partnering with Steve Carn and Randy Arnold to build the Compost360 platform, each of whom has decades of experience in the municipal solid waste industry,” said Lucas Cutler, Partner of The Sterling Group Foundation Fund. “Nature’s Choice is a nationally recognized leader in the organic recycling and mulch/soil market and is an exciting first addition to the Compost360 platform.”

“The Sterling team shares our vision of building a vertically-integrated organics waste recycling and composting platform with national scale, and their hands-on approach to operations will help us in executing this vision of partnering with best-in-class companies like Nature’s Choice,” said Steve Carn CEO of Compost360.

Compost360 is a portfolio company of The Sterling Group Foundation Fund. The Foundation Fund aims to leverage the firm’s operational capabilities and experience in the industrial sector to “set the foundation” for growth at lower middle market companies.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity and private credit investment firm that targets investments in basic manufacturing, distribution, and industrial services companies. Typical enterprise values of these companies at initial formation range from $100 million to $750 million. Sterling has sponsored the buyout of 66 platform companies and numerous add-on acquisitions for a total transaction value of over $14.0 billion. Sterling currently has over $5.9 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.