Investment Criteria

Corporate carve-outs, family / entrepreneur owned businesses or sponsor owned businesses

Basic industries, including manufacturing, distribution, industrial services and business services

Transaction sizes between $100 million and $1 billion

Equity investments between $50 million and $350 million

$5.9B

Assets undermanagement

75%

Family businesses or corporate carve-outs72

Number ofplatforms

$24B

Total value oftransactions

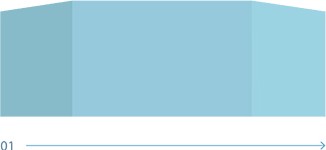

Our Seven Levers℠ Methodology

-

Businesses we buy

Businesses we buy

-

Seven levers℠

Seven levers℠

-

Businesses we sell

Businesses we sell

The Seven Levers℠ are the areas in which we consistently and materially impact businesses.

- The seven levers contain our collective experience in operations improvement over nearly 4 decades.

- They are based on the principles of continuous improvement.

- The seven levers are resources our management teams can use to enable speed, confidence and consistency in business building.