Houston, TX February 20, 2020

The Sterling Group, a Houston-based, operationally focused middle market private equity firm, announces the additions of Erin Arnold as Director, and Chris Ahearn as Commercial Operating Partner, as well as the promotions of Steven Hirsch and John Griffin to Principal.

Erin Arnold, Director, rejoins Sterling’s investment team from Madison Dearborn Partners, where she was most recently a Director with the Basic Industries team. Before rejoining the Sterling team this year, Erin worked at The Sterling Group in 2013 and 2014. She has also worked with Boston Consulting Group, Greenbriar Equity Group, and Credit Suisse.

In the role of Commercial Operating Partner, Chris will work to drive commercial operations effectiveness within Sterling portfolio companies. Chris brings many years of commercial operations experience gained at various firms, including RR Donnelly’s Western Division, FedEx Office, TPG Capital’s Operating Group, and most recently Oakwood Worldwide, where he was formerly SVP Sales and Marketing and most recently CEO.

Steven Hirsch, Principal, joined Sterling in 2017 from McKinsey & Company where he focused on strategic and operational topics for transportation, manufacturing and distribution companies. Steven previously held roles in program management and revenue management at American Airlines during the Chapter 11 bankruptcy and restructuring process.

John Griffin, Principal, joined Sterling in 2018 from McKinsey & Company where he was focused on operational and strategic initiatives for industrial and energy businesses. John also brings experience from Madison Dearborn Partners where he worked across Basic Industries, Business & Government Services, and Financial Services verticals.

About The Sterling Group

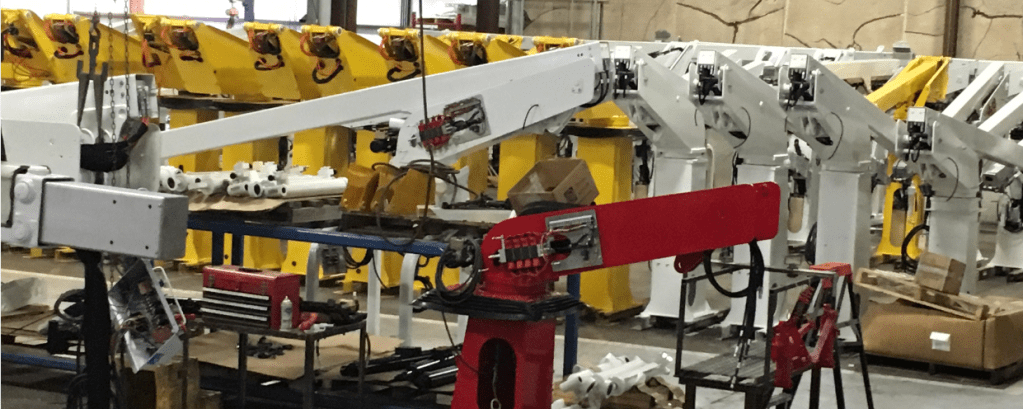

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 56 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $2.0 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.