Houston, TX July 24, 2017

The Sterling Group, an operationally focused middle market private equity firm, completed the sale of DexKo Global Inc. (“DexKo”) to funds managed by KPS Capital Partners, LP. Financial terms of the transaction were not disclosed.

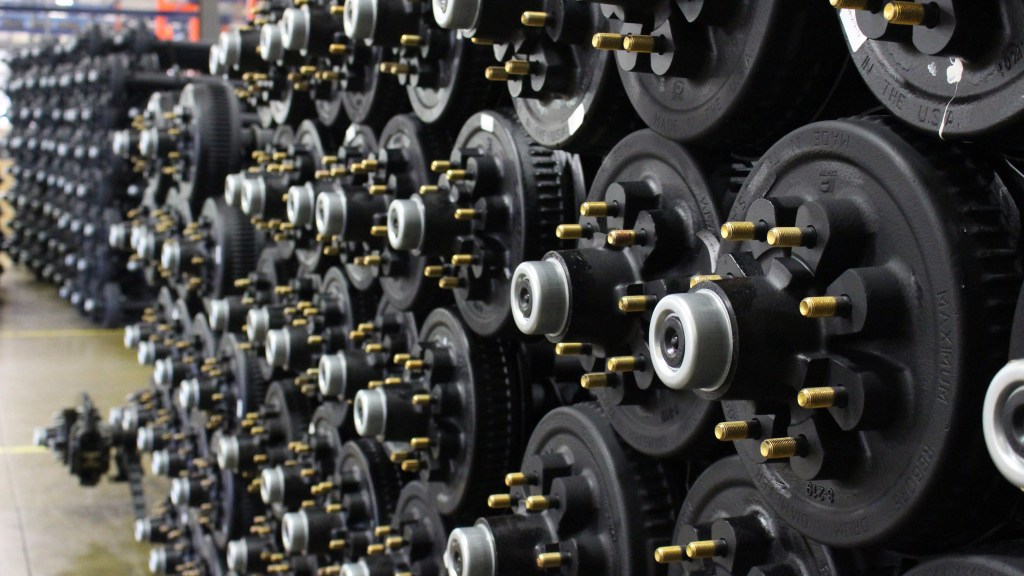

DexKo is the leading global supplier of highly engineered running gear technology, chassis assemblies and related components with over 130 years of trailer and caravan componentry experience. The company is headquartered in Novi, Michigan and employs over 4,500 employees with 39 manufacturing facilities and 25 distribution centers across the globe. Sterling formed DexKo at the end of 2015 through the combination of Dexter Axle and AL-KO Vehicle Technology.

“Sterling’s partnership with the deep and talented management team at DexKo has resulted in a complete transformation of the business over the last several years,” said Kevin Garland, a Partner at The Sterling Group. “We look forward to the company’s future success in the years to come.” Sterling will continue to own a minority stake in DexKo.

Goldman Sachs & Co. and J.P. Morgan Securities LLC served as financial advisors to DexKo. Harris Williams & Co. acted a special advisor to the Board, and Willkie Farr & Gallagher acted as legal counsel.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 51 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $2.2 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.