Houston, TX March 06, 2019

The Sterling Group, an operationally focused middle market private equity firm, today announced that it has completed the sale of Process Barron to funds managed by Carousel Capital.

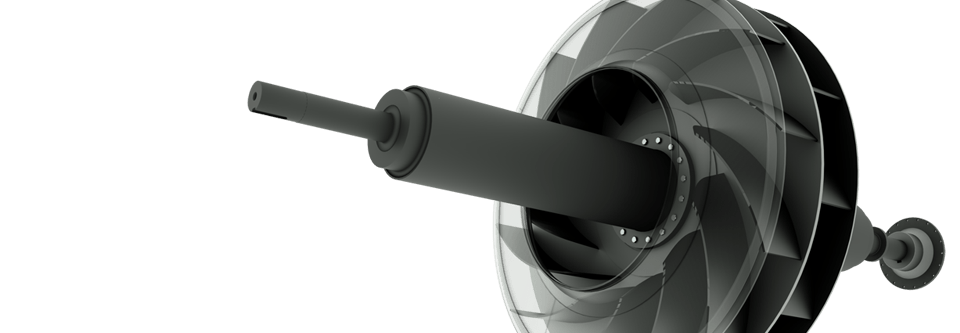

Headquartered in Birmingham, Alabama, Process Barron designs, manufactures and installs industrial process fans and material handling systems and provides follow-on service and maintenance for this equipment. Process Barron serves various industries including pulp and paper, power, steel, cement, food, and agriculture.

Sterling partnered with Process Barron’s management team, members of its founding family, in 2015. “Important to our family was the right cultural fit and the ability to reinvest alongside our partners,” said Ken Nolen, CEO of Process Barron. “Sterling has been the right partner for our family and for all employees. We look forward to future continued growth with Carousel Capital.”

Founded in 1982, Sterling has a long history of partnering with family owned businesses. Recent family or entrepreneur owned partnerships include those with Tangent Technologies, Time Manufacturing, Construction Supply Group, and Evergreen North America.

Terms of the transaction were not disclosed. Houlihan Lokey and Willkie Farr & Gallagher advised Sterling on the transaction.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 54 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $1.9 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.