Houston, TX February 23, 2024

The Sterling Group (“Sterling”), a middle market private equity firm, announced today that it has completed the sale of Evergreen North America Industrial Services (“Evergreen”) to Quanta Services. Evergreen is a leading provider of specialized and recurring environmental solutions for a diverse range of blue-chip industrial businesses and mission critical infrastructure.

Sterling created Evergreen through the combination of family owned, New York based North American Industrial Services and Houston based Evergreen Environmental Services. Since the combination, Evergreen has continued to expand its footprint and grow its ability to serve customers with its solutions nationally. Combined with Quanta Services leadership in specialty infrastructure solutions, Evergreen is poised to continue its track record of delivering the highest quality services to its customers.

Latham & Watkins served as legal counsel and BlackArch Partners served as financial advisor to Evergreen and Sterling.

About Evergreen North America Industrial Services

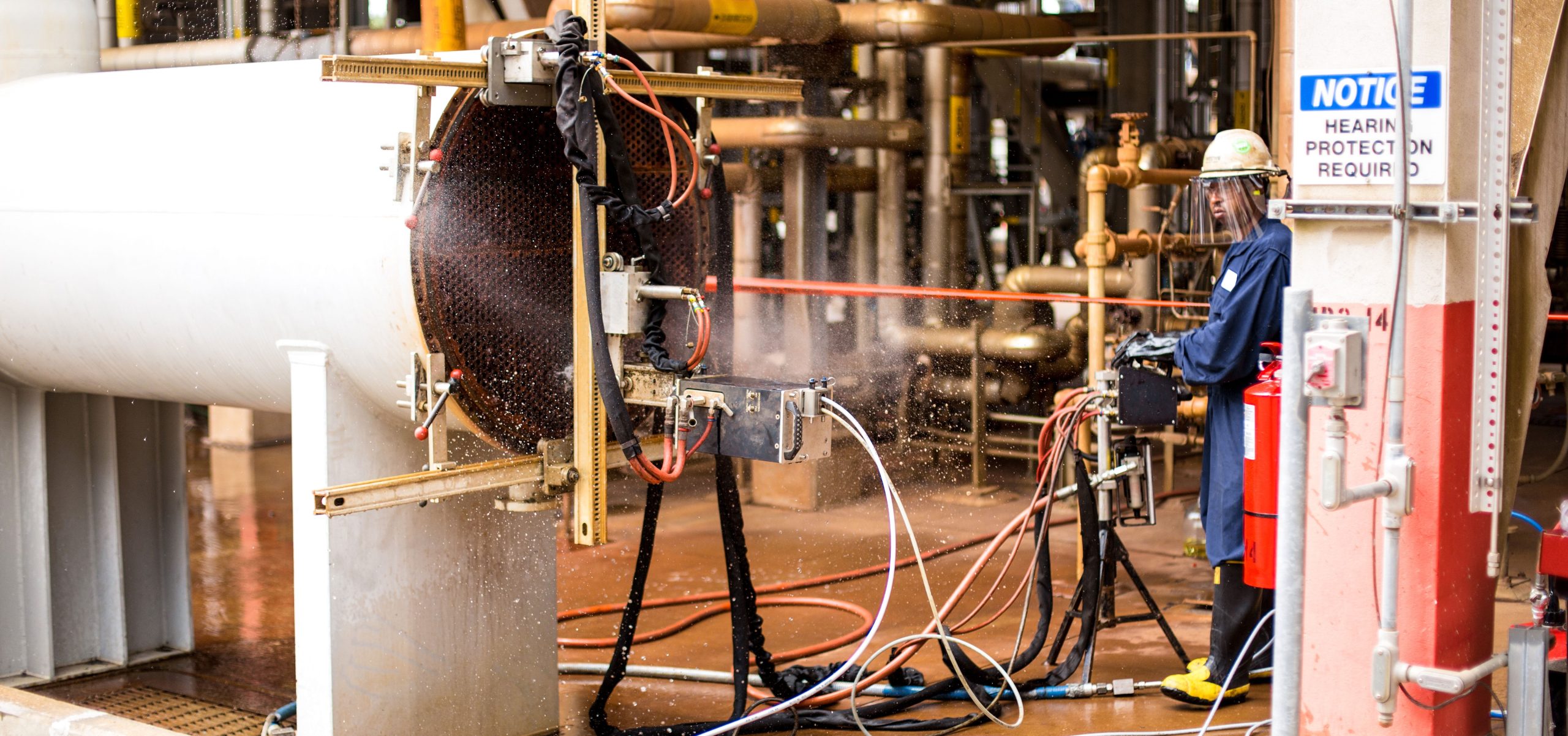

Evergreen is a leading provider of environmental solutions to the downstream and midstream energy, industrial, and chemical sectors. With a customer-centric culture and employees committed to safety, integrity, accountability and adaptability, Evergreen serves a diverse set of end markets, including refining, power generation, petrochemical, manufacturing, mining, waste-to-energy, and pulp & paper at locations throughout North America. Additional information about Evergreen is available at www.enais.com.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity and private credit investment firm that targets investments in basic manufacturing, distribution, and industrial services companies. Typical enterprise values of these companies at initial formation range from $100 million to $1 billion. Sterling has sponsored the buyout of 67 platform companies and numerous add-on acquisitions for a total transaction value of over $22 billion. Sterling currently has over $6 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.