Houston, TX December 11, 2017

The Sterling Group, a private equity firm based in Houston, Texas, announced that its portfolio company, Safe Fleet, has completed the acquisition of MobileView (“MOBILEVIEW”) from Interlogix, a part of UTC Climate, Controls & Security, a unit of United Technologies Corp. This marks Safe Fleet’s tenth acquisition during Sterling’s ownership, as well as their third corporate carve-out. Safe Fleet is a leading supplier of safety components for fleet vehicles.

MOBILEVIEW is the leading provider of mobile surveillance and video management solutions to more than 35,000 transit bus and rail vehicles in the United States. MOBILEVIEW’S products enable transportation professionals to capture, record, analyze, and control video evidence to enhance security, maximize resources, and increase vehicle uptime.

“MOBILEVIEW’S solutions are best-in-class servicing a significant number of transit agencies in North America. We believe the addition of MOBILEVIEW to Safe Fleet’s leading video positions in school and transit bus, fire, law enforcement, waste, and commercial markets extends Safe Fleet’s position as the largest global provider of video solutions to the fleet market,” stated John Knox, CEO of Safe Fleet. Safe Fleet’s acquisition of MOBILEVIEW is the company’s sixth acquisition in the video and telematics sector.

“Sterling and Safe Fleet management have partnered together to build a winning business in Safe Fleet,” said Brian Henry, Partner at The Sterling Group. “Through a series of organic initiatives and a wide variety of acquisitions, we have built a business that better serves customers.”

About Safe Fleet

Headquartered in Belton, MO, Safe Fleet owns a portfolio of brands that provide safety solutions to fleet vehicle manufacturers and operators around the world. These brands serve several major markets including: Bus, Rail, RV, Truck & Trailer, Work Truck, Law Enforcement, Emergency, Waste, Industrial and Military. With over 1,100 employees and 10 manufacturing locations, Safe Fleet targets markets with increasing demand for operator, passenger, and pedestrian safety. For more information about Safe Fleet and our portfolio of brands please visit www.safefleet.net.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 51 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $2.2 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX October 25, 2017

The Sterling Group, a private equity firm based in Houston, Texas, announced that its portfolio company, Safe Fleet, has completed the acquisition of COBAN Technologies, Inc. (“COBAN”). This marks Safe Fleet’s ninth acquisition during Sterling’s ownership. Safe Fleet is a leading supplier of safety components for fleet vehicles.

COBAN is a leading supplier of body cameras and in-car video solutions for law enforcement. “COBAN is an excellent addition to Safe Fleet’s portfolio. We believe the combination of COBAN’s position in law enforcement with Safe Fleet’s leading video positions in School and Transit Bus, Fire, Waste, and Commercial markets establishes Safe Fleet as the largest global provider of video solutions to the fleet market,” stated John Knox, CEO of Safe Fleet. “Safe Fleet/COBAN is now the only video provider able to comprehensively supply common and integrated video solutions to all First Responder departments as well as all municipal fleet markets.”

“The partnership with COBAN further strengthens Safe Fleet’s robust family of technology and safety solutions for a growing list of fleet end markets,” said Gary Rosenthal, Partner at The Sterling Group. COBAN marks the company’s fifth acquisition in the video and telematics sector.

About Safe Fleet

Headquartered in Belton, MO, Safe Fleet owns a portfolio of brands that provide safety solutions to fleet vehicle manufacturers and operators around the world. These brands serve several major markets including: Bus, Rail and RV, Truck and Trailer, Work Truck, Emergency, Waste, and Industrial and Military. With over 1,100 employees and 10 manufacturing locations, Safe Fleet targets markets with increasing demand for operator, passenger, and pedestrian safety. For more information about Safe Fleet and our portfolio of brands please visit www.safefleet.net.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 52 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $2.1 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX July 24, 2017

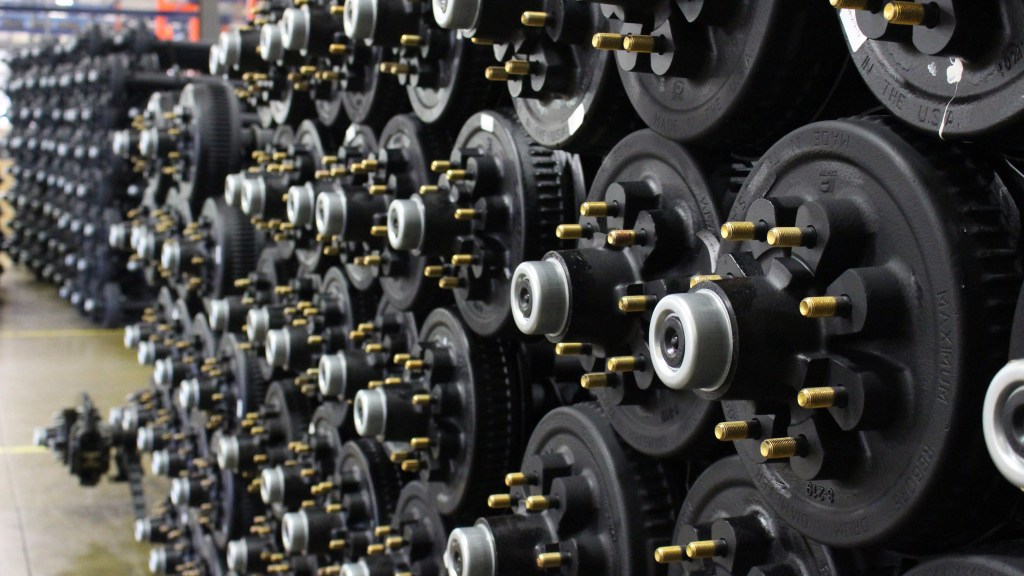

The Sterling Group, an operationally focused middle market private equity firm, completed the sale of DexKo Global Inc. (“DexKo”) to funds managed by KPS Capital Partners, LP. Financial terms of the transaction were not disclosed.

DexKo is the leading global supplier of highly engineered running gear technology, chassis assemblies and related components with over 130 years of trailer and caravan componentry experience. The company is headquartered in Novi, Michigan and employs over 4,500 employees with 39 manufacturing facilities and 25 distribution centers across the globe. Sterling formed DexKo at the end of 2015 through the combination of Dexter Axle and AL-KO Vehicle Technology.

“Sterling’s partnership with the deep and talented management team at DexKo has resulted in a complete transformation of the business over the last several years,” said Kevin Garland, a Partner at The Sterling Group. “We look forward to the company’s future success in the years to come.” Sterling will continue to own a minority stake in DexKo.

Goldman Sachs & Co. and J.P. Morgan Securities LLC served as financial advisors to DexKo. Harris Williams & Co. acted a special advisor to the Board, and Willkie Farr & Gallagher acted as legal counsel.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 51 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $2.2 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX July 06, 2017

The Sterling Group, a Houston-based middle market private equity firm, announced that its portfolio company, Construction Supply Group, has completed the acquisition of Carter Waters. Construction Supply Group is a leader in the distribution of construction materials and accessories and tools, primarily for professional concrete and masonry contractors in the United States and Canada. The combined company has 72 branches with 1,150 employees and offers over 70,000 SKUs to nearly 25,000 customers.

Carter Waters is the fifth business acquired by Sterling as part of the Construction Supply platform. In late 2016, Sterling acquired Brock White Company, LLC, Border Construction Specialties, LLC and Stetson Building Products to form Construction Supply Group. Brock White, Border and Stetson have strong branch footprints in Western Canada, the Upper Midwest and the Southwest. The company later executed a carve-out of five Gerdau distribution branches in the Midwest. The acquisition of Carter Waters’ 19 construction distribution branches will expand the company’s lower Midwest footprint ranging from Kansas to Ohio.

“We are thrilled to welcome the Carter Waters team to the Construction Supply family. They have built an exceptional business that will continue to provide exceptional service to customers while expanding our footprint,” said Mitch Williams, CEO of Construction Supply Group.

The scale of Construction Supply has grown rapidly through the combination of 5 leading distributors, each with no more than 20 branches but with exceptional track records of growth, customer service and loyal customer relationships. Construction Supply Group will continue to seek further additions to its family of construction distribution businesses.

Willkie Farr & Gallagher provided legal counsel to Construction Supply Group. Raymond James served as Carter Waters’ exclusive financial advisor.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 51 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $2.2 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX May 30, 2017

The Sterling Group, an operationally focused middle market private equity firm, today announced a definitive agreement to sell DexKo Global Inc. (“DexKo”) to funds managed by KPS Capital Partners, LP. Financial terms of the transaction were not disclosed.

DexKo is the leading global supplier of highly engineered running gear technology, chassis assemblies and related components with over 130 years of trailer and caravan componentry experience. The company is headquartered in Novi, Michigan and employs over 4,500 employees with 39 manufacturing facilities and 25 distribution centers across the globe. Sterling formed DexKo at the end of 2015 through the combination of Dexter Axle and AL-KO Vehicle Technology.

“Sterling’s partnership with the deep and talented management team at DexKo has resulted in a complete transformation of the business over the last several years,” said Kevin Garland, a Partner at The Sterling Group. “We look forward to the company’s future success in the years to come.” Sterling will continue to own a minority stake in DexKo.

Completion of the transaction is expected in mid-2017 and is subject to customary closing conditions and approvals. Goldman Sachs and J.P. Morgan Securities LLC served as financial advisors to DexKo. Harris Williams & Co. acted as a special advisor to the Board, and Willkie Farr & Gallagher acted as legal counsel.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 51 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $2.2 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX May 03, 2017

The Sterling Group, a Houston-based middle market private equity firm, announced the acquisition of five distribution branches from Gerdau Construction Products. The branches will become a part of Sterling’s portfolio company, Construction Supply Group.

Construction Supply Group is a leader in the distribution of construction materials, accessories and tools, primarily for professional concrete and masonry contractors in the United States and Canada. The combined company has 53 branches with 850 employees and offers over 70,000 SKUs to nearly 25,000 customers.

In late 2016, Sterling acquired Brock White Company, LLC, Border Construction Specialties, LLC and Stetson Building Products to form Construction Supply Group. Brock White, Border and Stetson each have strong branch footprints in Western Canada, the Upper Midwest and the Southwest. The acquisition of the five Gerdau branches in Appleton, Wisconsin; Madison, Wisconsin; Decatur, Illinois; Urbana, Illinois and Eldridge, Iowa will allow Construction Supply Group to further serve customers in those territories.

“The Gerdau branch additions will further strengthen our footprint and ability to provide exceptional service to customers. We look forward to partnering with the Gerdau employees as we continue to build the platform,” said Mitch Williams, CEO of Construction Supply Group.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 51 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $2.2 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX April 12, 2017

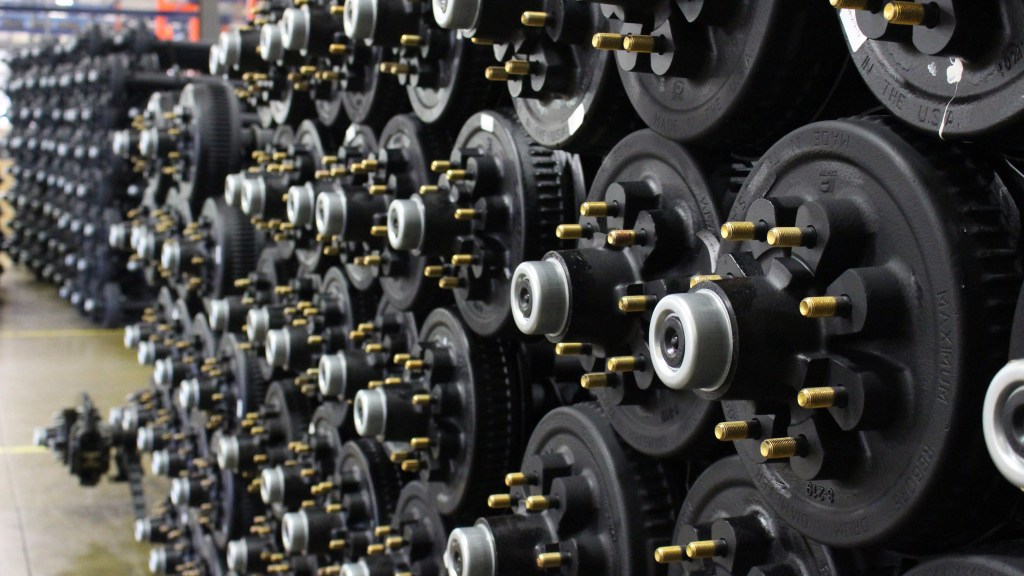

Lynx FBO Network, a buy-and-build effort in the FBO (fixed base operator) industry, today announced the appointment of Scott Kelly, retired astronaut and US Navy captain, and Dan Bucaro, former CEO of Landmark Aviation, to its Board of Directors. In September 2016,The Sterling Group, a middle market private equity firm focused on industrial businesses, began executing a plan to build a leading FBO network providing general aviation services. Lynx completed four acquisitions in the first four months of operations.

Scott Kelly is an astronaut and retired US Navy Captain who is a veteran of four space flights and commanded the International Space Station on three different expeditions. Dan Bucaro has been involved in the FBO industry for over 15 years, having built the Trajen, Encore and Landmark businesses. Dan was most recently CEO of Landmark Aviation, an FBO network with 70 locations that was sold by The Carlyle Group to BBA Aviation in February 2016.

“Scott will bring invaluable strategic and operational direction to the Board, and Dan brings unparalleled experience and success in the FBO industry,” said Greg Elliott, a Partner at The Sterling Group.“We are thrilled to be adding strength to the already deep team at Lynx.”

In addition, the company announced that Matt DeLellis joined as Chief Financial Officer and Leslie McIntyre joined as Executive Vice President of Human Resources. DeLellis was formerly the Senior Vice President for Strategy and Corporate Development and McIntyre was the Vice President of Human Resources, both at Landmark Aviation.

Sterling has assembled a strong and experienced team to build the new network. Greg Elliott, has been involved in building several FBO networks in the past fifteen years, including roles as the Chairman of Encore and Trajen, and Board member of Landmark Aviation. Chad Farischon and Tyson Goetz are former members of the Trajen, Atlantic Aviation, and Landmark Aviation management teams and have been involved with the purchase and integration of over 50 FBOs over the course of their careers. Lynx is the sole service provider at air fields near Destin, Florida; Portland, Oregon; and Minneapolis, Minnesota and is actively pursuing further acquisitions.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 50 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $2.2 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX February 06, 2017

The Sterling Group, a middle market private equity firm based in Houston, Texas, today announced that it acquired Time Manufacturing Company (“Time”) from O’Flaherty Holdings Limited.

Headquartered in Waco, Texas, Time is a global designer, manufacturer, and distributor of vehicle-mounted aerial lifts primarily for the telecom and electric utility end markets. Time has pioneered several brands within the aerial lift market, including the market leading Versalift brand. The business had been owned by the O’Flaherty family for over 40 years.

“Sterling is the right partner for Time as we continue to pursue the significant growth opportunities that exist for the company today,” said Charles Wiley, CEO of Time. “The Time team is excited to partner with Sterling, and together we expect continued success in this next phase of our company’s history.”

“The team at Time has built the company into an industry leader that provides outstanding products and services to its customers, and we look forward to further supporting their future growth,” said Kent Wallace, a Partner at The Sterling Group. Sterling has a long history of partnering with management teams of family- and entrepreneur-owned businesses in the industrial sector.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of over 50 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $2.2 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX January 16, 2017

The Sterling Group, a private equity firm based in Houston, Texas, announced that its portfolio company, Safe Fleet, has completed the acquisition of Randall Manufacturing LLC (“Randall”). This marks Safe Fleet’s eighth acquisition during Sterling’s ownership. Safe Fleet is a leading supplier of safety components for fleet vehicles.

Based in suburban Chicago, Illinois, Randall is a leading manufacturer of specialized safety products used mainly in refrigerated semi-trailers in connection with the transportation of food and beverages. “Randall is an excellent addition to Safe Fleet’s portfolio. Through innovation and consistent execution, Randall has developed a high level of brand equity and trust with their customers and end-users,” stated John Knox, CEO of Safe Fleet. “The Randall brand and product line strongly complements Safe Fleet’s truck and trailer offerings. We are delighted to welcome Fred Jevaney and the Randall organization to Safe Fleet.”

Safe Fleet provides a wide variety of safety-and productivity-oriented components to bus, rail, RV, truck and trailer, work truck, emergency, waste, industrial and military end markets. “The addition of the Randall team and product will further Safe Fleet’s ability to offer a full line of safety solutions to our wide range of fleet customers,” said Brian Henry, a Partner at The Sterling Group.

Safe Fleet has more than doubled in size during its partnership with Sterling and will continue to pursue both organic and acquisition related growth.

About Safe Fleet

Headquartered in Belton, MO, Safe Fleet owns a portfolio of brands that provide safety solutions to fleet vehicle manufacturers and operators around the world. These brands serve several major markets including: Bus, Rail and RV, Truck and Trailer, Work Truck, Emergency, Waste, and Industrial and Military. Within Truck and Trailer, the ROM and Bustin brands provide a variety of access and safety products specific to over the road semi-trailers, including refrigerated semi-trailers. With over 1,100 employees and 10 manufacturing locations, Safe Fleet targets markets with increasing demand for operator, passenger, and pedestrian safety. For more information about Safe Fleet and our portfolio of brands please visit www.safefleet.net.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 50 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $2.2 billion of assets under management. For further information please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX January 03, 2017

The Sterling Group, a middle market private equity firm based in Houston, Texas, today announced that its platform company, Lynx FBO Network, has completed two acquisitions at Anoka County-Blaine Airport serving the Minneapolis/St. Paul metropolitan area, with prime access to US Bank Stadium and downtown Minneapolis. Lynx simultaneously acquired both Cirrus Flight Operations and Key Air Twin Cities. “We look forward to bringing the Lynx level of service and our extensive FBO expertise to the Minneapolis/St. Paul area,” said Chad Farischon, a Partner with Lynx.

In August 2016, Sterling launched Lynx, a buy-and-build effort in the FBO industry, and is executing a plan to build a leading FBO network providing general aviation services. The Cirrus and Key locations at Anoka mark the third and fourth acquisitions for Lynx during the first four months of operations.

“Key Air Twin Cities has developed world class FBO terminal and hangar facilities, a state of the art fuel farm, and a large ramp capable of handling significant aircraft activity in a safe and efficient manner. Those attributes combined with the Lynx team’s experience in handling special events, the ease of access to US Bank stadium, and a group of talented employees joining our team from both Cirrus and Key make Lynx the optimal location to serve our customers during the 2018 Super Bowl,” stated Tyson Goetz, a Partner with Lynx.

Sterling has assembled a strong and experienced team to build the new network. Greg Elliott, a Partner at The Sterling Group, has been involved in building several FBO networks in the past fifteen years, including roles as the Chairman of Encore and Trajen, and Board member of Landmark Aviation. Chad Farischon and Tyson Goetz are former members of both the Trajen, Atlantic Aviation, and Landmark Aviation management teams and have purchased and integrated over 50 FBOs over the course of their careers. The pipeline for further acquisitions remains strong.

“Anoka County is an excellent addition to our rapidly growing network,” said Greg Elliott. Lynx currently operates locations near Destin, Florida, Portland, Oregon and now Minneapolis, Minnesota. Lynx and Sterling are actively seeking acquisitions in North America.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 50 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $2.2 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.