Southlake, TX April 04, 2019

Artisan Design Group (“ADG”), a portfolio company of The Sterling Group, today announced the acquisition of Markraft Cabinets, LLC (“Markraft Cabinets”). ADG is a dealer of flooring products and services, providing design, procurement, installation and quality control of flooring and complimentary products for homebuilders.

Headquartered in Wilmington, North Carolina, Markraft Cabinets is a leading provider of design and installation services for cabinetry and countertops in North Carolina, South Carolina and Tennessee. “We are excited to join the ADG family of companies because of our shared entrepreneurial cultures and focus on providing excellent selection and service to customers,” said Joe Jacobus, CEO of Markraft Cabinets.

“We see this expansion into cabinets and countertops, and in particular in the Carolinas and Tennessee, as an integral part of the growing ADG platform. Joe and the Markraft Cabinets team have grown the company into a clear leader in its markets, and we look forward to the many benefits each of our respective businesses will enjoy from being partners,” said Larry Barr and Wayne Joseph, Co-CEOs of ADG.

Headquartered in Southlake, Texas, ADG operates more than 40 distribution, design and service facilities and coordinates installation through over 1,000 independent contractors across 15 states. ADG was formed in 2016 through the combination of Floors Inc. and Malibu. The acquisition of Markraft Cabinets represents ADG’s tenth acquisition in the past two years. The company continues to seek local and regional market leaders to add to its family of flooring specialists.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 55 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $1.9 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX March 15, 2019

The Sterling Group, an operationally focused middle market private equity firm, today announced the acquisition of Polychem Corporation. Polychem is a leading manufacturer of polyester (“PET”) and polypropylene strapping in the North American securement packaging industry. The company manufactures polyester (“PET”) and polypropylene strapping consumables, securement equipment and related products, serving the food and beverage, consumer packaged goods, and industrial industries.

Headquartered in Mentor, Ohio, Polychem has operated as a family business since the 1980s. Polychem is vertically integrated, operating a PET recycling facility which processes bales of post-consumer PET, converting them for use in Polychem’s strapping extrusion lines and for external sale to consumer packaged goods companies. Polychem also manufactures and sells a variety of securement packaging equipment to complement its consumable offering.

“We look forward to working with Polychem to continue to build on the company’s long history of successfully serving customers with quality products and innovative securement solutions,” said Gary Rosenthal, a Partner at The Sterling Group.

The Sterling Group has extensive experience in the packaging sector, including previous investments in Liqui-Box, Exopack and Saxco.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 55 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $1.9 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX March 06, 2019

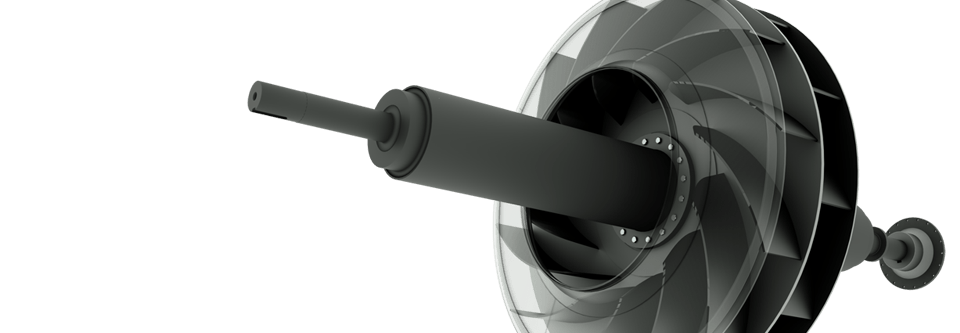

The Sterling Group, an operationally focused middle market private equity firm, today announced that it has completed the sale of Process Barron to funds managed by Carousel Capital.

Headquartered in Birmingham, Alabama, Process Barron designs, manufactures and installs industrial process fans and material handling systems and provides follow-on service and maintenance for this equipment. Process Barron serves various industries including pulp and paper, power, steel, cement, food, and agriculture.

Sterling partnered with Process Barron’s management team, members of its founding family, in 2015. “Important to our family was the right cultural fit and the ability to reinvest alongside our partners,” said Ken Nolen, CEO of Process Barron. “Sterling has been the right partner for our family and for all employees. We look forward to future continued growth with Carousel Capital.”

Founded in 1982, Sterling has a long history of partnering with family owned businesses. Recent family or entrepreneur owned partnerships include those with Tangent Technologies, Time Manufacturing, Construction Supply Group, and Evergreen North America.

Terms of the transaction were not disclosed. Houlihan Lokey and Willkie Farr & Gallagher advised Sterling on the transaction.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 54 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $1.9 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX March 04, 2019

Artisan Design Group (“ADG”), a portfolio company of The Sterling Group, today announced the acquisition of Builders Wholesale Flooring (“Builders Wholesale” or the “Company”). ADG is a dealer of flooring products and services, providing design, procurement, installation and quality control of flooring and complimentary products for homebuilders.

Headquartered in Columbia, South Carolina, Builders Wholesale is the leading provider of flooring products and services in the Carolinas region. “We decided to join the ADG family because of our shared values which center on a commitment to providing customers with best in class flooring selections and service,” said Wayne Martin, President of Builders Wholesale.

“Wayne and the Builders Wholesale team have grown Builders Wholesale into a clear leader in its markets with an entrepreneurial culture and a reputation for excellence, a perfect fit with Artisan Design Group. We welcome Builders Wholesale to the ADG family and look forward to the many benefits each of our respective businesses will enjoy from being partners,” said Larry Barr and Wayne Joseph, Co-CEOs of ADG.

Headquartered in Southlake, Texas, ADG operates more than 40 distribution, design and service facilities and coordinates installation through over 800 independent contractors across 13 states. ADG was formed in 2016 through the combination of Floors Inc. and Malibu. The acquisition of Builders Wholesale represents ADG’s ninth acquisition in the past two years. The Company continues to seek local and regional market leaders to add to its family of flooring specialists.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 54 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $1.9 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX February 05, 2019

The Sterling Group, an operationally focused private equity firm based in Houston, Texas, announced the promotions of Scott MacLaren, Franny Jones, Max Klupchak, and Claudine Lussier.

Scott MacLaren has been promoted to Managing Director. Scott joined Sterling in 2014 from The Boston Consulting Group and has played an integral role on the deal teams of American Bath Group, Highline Aftermarket, Lynx FBO Network, and Evergreen North America. Scott spent a year embedded at American Bath Group where he successfully drove major transformation at the company.

Franny Jones has been promoted to Managing Director. Franny joined Sterling in 2010 to focus on the firm’s fundraising and investor relations efforts. With Franny’s leadership in this area, Sterling has further enhanced its fundraising capabilities and transparent communications with investors.

Max Klupchak has been promoted to General Counsel. Max joined Sterling in 2015 from Kirkland &Ellis LLP to oversee legal matters at the firm. Max has built out Sterling’s internal legal processes and has also had a meaningful impact advising Sterling’s portfolio companies.

Claudine Lussier has been promoted to Principal. Claudine joined Sterling in 2017 from Jacobs Engineering. In a short period of time, Claudine has driven improvements in all areas of Sterling’s talent development activities, both internally and at Sterling portfolio companies.

“We are thrilled to recognize these four outstanding contributors to The Sterling Group. Each shares a passion for building winning industrial businesses and a focus on continuous improvement,” said Brad Staller, a Partner at Sterling.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 54 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $1.9 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX February 04, 2019

Lynx FBO Network (Lynx), a portfolio company of The Sterling Group, announced today it has acquired the FBO assets of World Jet, Inc. at Fort Lauderdale Executive Airport (FXE) in Fort Lauderdale, Florida. The acquisition will mark Lynx’s seventh FBO location.

“We see this expansion into the Florida market, and in particular South Florida, as an integral part of our growing network of FBOs. Lynx looks forward to working with the Fort Lauderdale Executive Airport, the city of Fort Lauderdale and the local FBO team to deliver a best-in-class service offering for our customers in the South Florida region,” said Chad Farischon, President & Partner with Lynx.

In the coming months, Lynx will be making significant investments in the newly acquired facility, including a refresh of the facility grounds and the design and development of a new FBO terminal.

Lynx is a rapidly growing network of FBOs in the general aviation industry with locations in Destin, Florida, Minneapolis (Anoka), Minnesota, Portland (Aurora), Oregon, Little Rock, Arkansas, Napa, California, Pittsburgh, Pennsylvania and now Fort Lauderdale, Florida. The Lynx vision is to build a values-based FBO network known for exceptional service and quality, a rewarding team member experience, and a commitment to continuing excellence. The Lynx team is comprised of industry veterans who have worked together building FBO networks over many years, serving in management roles at numerous large FBO networks including Landmark Aviation, Atlantic Aviation and Trajen. Lynx and Sterling continue to actively seek FBO acquisitions in North America.

Honigman Miller Schwartz & Cohn LLP served as legal advisor to Lynx in the acquisition.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 54 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $1.9 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX December 14, 2018

The Sterling Group, an operationally focused middle market private equity firm, today announced the acquisition of Artisan Design Group (“ADG”). ADG is a dealer of flooring products and services, providing design, procurement, installation and quality control of flooring and complimentary products for homebuilders.

Headquartered, in Southlake, Texas, ADG operates 39 distribution, design and service facilities and coordinates installation through over 800 independent contractors across 13 states. The business was formed in 2016 through the combination of Floors Inc. and Malibu. ADG has completed 8 other acquisitions since that time, bringing together many of the leading regional flooring specialists across the United States. “In a short period of time, Larry Barr and Wayne Joseph have built an industry leading flooring specialist with significant scale,” said Kent Wallace, a Partner at The Sterling Group. “We look forward to supporting their continued expansion both organically and through further acquisitions.”

“Sterling’s partnership means we can continue to recruit other industry leaders to join ADG to provide excellent products and services to an expanded client base across the country,” said Larry Barr, Co-CEO of ADG.

“Sterling’s experience investing alongside entrepreneurs to grow their businesses will benefit ADG as we continue to expand in the years to come,” said Wayne Joseph, Co-CEO of ADG.

The Sterling Group has a long history of partnering with entrepreneurs, particularly in the building products sector, including investments in Roofing Supply Group, American Bath Group, and Construction Supply Group.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 54 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $1.8 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX December 03, 2018

Construction Supply Group (“CSG”) has completed the simultaneous acquisitions of All-Tex Supply, MASONPRO, Inc. and Titan Construction Supply. Construction Supply Group is a leader in the distribution of specialty construction materials, accessories and tools, primarily for professional concrete and masonry contractors in the United States and Canada. The company has nearly 100 branches with over 1,350 employees and offers over 60,000 SKUs to more than 50,000 customers.

In the past two years, Construction Supply Group has brought together thirteen businesses to form the second largest specialty construction supply distributor in North America. The Sterling Group, an operationally focused private equity firm, partnered with management in late 2016 to build a new national leader.

The additions of All-Tex, MASONPRO and Titan will result in an expanded presence in the Texas, Oklahoma, Michigan, and Nevada markets, as well as an increased product offering within masonry specialty materials. “Today’s acquisitions further demonstrate CSG’s commitment to providing our customer base with industry leading products and service,” said Mitch Williams, CEO of Construction Supply Group.

“We look forward to partnering with Royce Farris and Don Tice from All-Tex, Jeff Snyder from MASONPRO and Mike Harmon from Titan,” said Brian Henry, a Partner at The Sterling Group. “We have been fortunate to bring together some of the best talent in the industry over the past two years, resulting in a stronger platform that can benefit from leveraging each other’s talents.”

Construction Supply Group continues to seek local and regional market leaders to add to its family of specialty construction supply distribution businesses.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of 52 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $1.8 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX November 01, 2018

Lynx FBO Network (“Lynx”), a portfolio company of The Sterling Group, announced today that it has completed the acquisition of the FBO assets of Voyager Jet Center (“Voyager Jet”) at Allegheny County Airport (“AGC”) in Pittsburgh, Pennsylvania. The acquisition of Voyager Jet marks Lynx’s sixth FBO location and third FBO acquired this year.

“We believe the Pittsburgh market, and its rise as a global innovation city, is a perfect complement to our growing network of FBOs and we look forward to working with the Allegheny County Airport Authority (ACAA), Voyager Jet and the local FBO team to deliver a best-in-class service offering for our customers in the Mid-Atlantic region,” said Matt DeLellis, Chief Financial Officer with Lynx.

Lynx is a rapidly growing network of FBOs in the general aviation industry with locations in Destin, Florida, Minneapolis (Anoka), Minnesota, Portland (Aurora), Oregon, Little Rock, Arkansas, Napa, California and now Pittsburgh, Pennsylvania. The Lynx vision is to build a values-based FBO network known for exceptional service and quality, a rewarding team member experience, and a commitment to continuing excellence. The Lynx team is comprised of industry veterans who have worked together building FBO networks over many years, serving in management roles at numerous large FBO networks including Landmark Aviation, Atlantic Aviation and Trajen. Greg Elliott, a Partner at The Sterling Group, has been involved in building several FBO networks in the past fifteen years, including roles as the Chairman of Encore and Trajen, and Board member of Landmark Aviation. Lynx and Sterling continue to actively seek FBO acquisitions in North America.

Terms of the transaction were not disclosed. Honigman Miller Schwartz & Cohn LLP served as legal advisor to Lynx.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of over 52 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $1.9 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.

Houston, TX October 03, 2018

The Sterling Group, a middle market private equity firm based in Houston, Texas, today announced that its portfolio company, Time Manufacturing/Versalift, has completed the acquisition of Aspen Aerials.

Headquartered in Waco, Texas, Time is a global designer, manufacturer, and distributor of vehicle-mounted aerial lifts primarily for the telecom and electric utility end markets. Time has pioneered several brands within the aerial lift market, including the market leading Versalift brand. Sterling acquired the business in 2017 from family owners to drive both organic and acquisition related growth.

Headquartered in Duluth, Minnesota, Aspen Aerials is the leading manufacturer of specialty equipment used to inspect the safety and integrity of bridges. “We are delighted to welcome Aspen Aerials, a market leading manufacturer in the bridge inspection space, to the Versalift family,” said Time Manufacturing CEO Curt Howell. “With this acquisition, we extend our reach into an important and growing industry, and continue to expand our offering of high-quality, safe and reliable equipment.”

Founded in 1982, Sterling has a long history of partnering with family owned businesses who are seeking the next phase of growth for their industrial businesses.

About The Sterling Group

Founded in 1982, The Sterling Group is a private equity investment firm that targets controlling interests in basic manufacturing, distribution and industrial services companies. Typical enterprise values of these companies range from $100 million to $750 million. Sterling has sponsored the buyout of over 52 platform companies and numerous add-on acquisitions for a total transaction value of over $10.0 billion. Currently, Sterling has over $1.9 billion of assets under management. For further information, please visit www.sterling-group.com.

Past performance is no guarantee of future results and all investments are subject to loss.